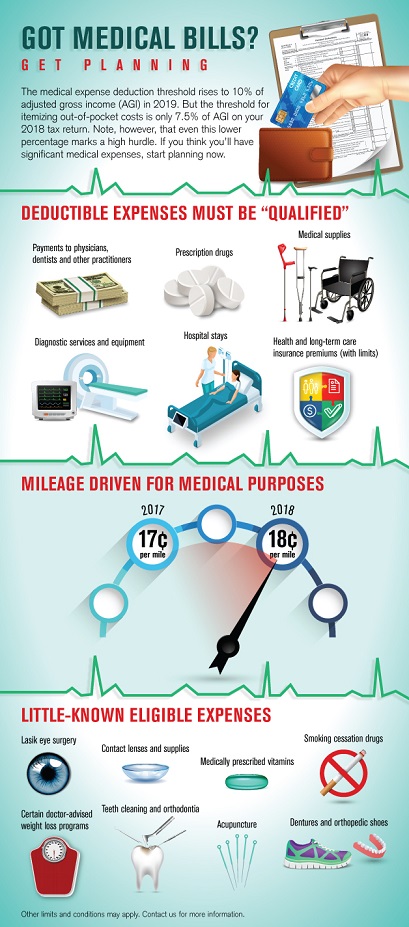

For 2018, the threshold for itemizing medical expenses is only 7.5% of AGI

- Details

- Published: Monday, 22 October 2018 09:30

- Written by Phillip Strickler, CPA.CITP

For investors, fall is a good time to review year-to-date gains and losses. Not only can it help you assess your financial health, but it also can help you determine whether to buy or sell investments before year end to save taxes. This year, you also need to keep in mind the impact of the Tax Cuts and Jobs Act (TCJA). While the TCJA didn’t change long-term capital gains rates, it did change the tax brackets for long-term capital gains and qualified dividends.

For 2018 through 2025, these brackets are no longer linked to the ordinary-income tax brackets for individuals. So, for example, you could be subject to the top long-term capital gains rate even if you aren’t subject to the top ordinary-income tax rate.

Old rules

For the last several years, individual taxpayers faced three federal income tax rates on long-term capital gains and qualified dividends: 0%, 15% and 20%. The rate brackets were tied to the ordinary-income rate brackets.

Specifically, if the long-term capital gains and/or dividends fell within the 10% or 15% ordinary-income brackets, no federal income tax was owed. If they fell within the 25%, 28%, 33% or 35% ordinary-income brackets, they were taxed at 15%. And, if they fell within the maximum 39.6% ordinary-income bracket, they were taxed at the maximum 20% rate.

You’ve no doubt heard the old business cliché “cash is king.” And it’s true: A company in a strong cash position stands a much better chance of obtaining the financing it needs, attracting outside investors or simply executing its own strategic plans.

One way to ensure that there’s always a king in the castle, so to speak, is to maintain a cash reserve. Granted, setting aside a substantial amount of dollars isn’t the easiest thing to do — particularly for start-ups and smaller companies. But once your reserve is in place, life can get a lot easier.

Common metrics

Now you may wonder: What’s the optimal amount of cash to keep in reserve? The right answer is different for every business and may change over time, given fluctuations in the economy or degree of competitiveness in your industry.

If you’re charitably inclined and you collect art, appreciated artwork can make one of the best charitable gifts from a tax perspective. In general, donating appreciated property is doubly beneficial because you can both enjoy a valuable tax deduction and avoid the capital gains taxes you’d owe if you sold the property. The extra benefit from donating artwork comes from the fact that the top long-term capital gains rate for art and other “collectibles” is 28%, as opposed to 20% for most other appreciated property.

Requirements

The first thing to keep in mind if you’re considering a donation of artwork is that you must itemize deductions to deduct charitable contributions. Now that the Tax Cuts and Jobs Act has nearly doubled the standard deduction and put tighter limits on many itemized deductions (but not the charitable deduction), many taxpayers who have itemized in the past will no longer benefit from itemizing.

For 2018, the standard deduction is $12,000 for singles, $18,000 for heads of households and $24,000 for married couples filing jointly. Your total itemized deductions must exceed the applicable standard deduction for you to enjoy a tax benefit from donating artwork.